Unlock capital for time-sensitive deals, innovative projects, and ambitious expansion plans with our flexible business loans for Australian SMEs.

From acquisitions to capital projects, our corporate loans empower businesses to take the next strategic step, backed by flexible funding solutions that align with your goals.

Capitalize on lucrative real estate or business ventures with our specialized financing solutions designed to support your financial strategies.

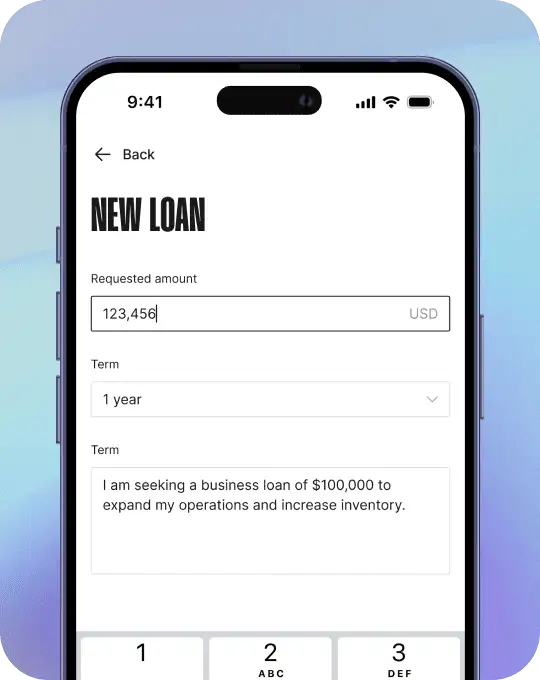

You don’t need to jump through a whole lot of hoops to get the loan you need with DCF Loans. Our streamlined process and dedicated team ensure a hassle-free experience, from application to funding.

Get funds for your business goals

Get a decision quickly, so you can act fast

No hidden fees or surprises

Our experienced team will guide you through every step

We're dedicated to helping SME to mid-market Australian companies thrive

Once approved, funds can be in your account the same day.

Loan terms range from 1 to 5 years with monthly payments based on loan size and term.

Our loan solutions empower Australian businesses to overcome challenges and seize opportunities with fast, fair, and flexible funding, typically secured against residential or commercial property.

Bridge the financial gap between property transactions, seize opportunities, and maintain momentum with our fast and flexible bridging loans.

Unlock capital for time-sensitive deals, innovative projects, and ambitious expansion plans with our flexible loans for Australian SMEs.

Empower your enterprise with strategic financing solutions tailored for growth, acquisitions, and capital projects.

Bridge the financial gap between property transactions, seize opportunities, and maintain momentum with our fast and flexible bridging loans.

Access flexible funding on demand to manage cash flow and seize opportunities

Drive away in your dream car with affordable financing

Assuming benchmark rate of 12%, actual

repayments may vary

Your funding solution is just a few clicks away. Apply now and experience the DCF Loans difference.

DCF Loans Team

DCF Loans Team

DCF Loans Team

DCF Loans Team

DCF Loans Team

DCF Loans Team

DCF Loans Team

DCF Loans Team

DCF Loans Team

DCF Loans Team

DCF Loans Team

DCF Loans Team

DCF Loans Team

DCF Loans Team

DCF Loans Team

DCF Loans Team

DCF Loans Team

DCF Loans Team

DCF Loans Team

DCF Loans Team

Loan amounts and terms provided are illustrative only and may be adjusted at the lender’s sole discretion without prior notice. Approval and eligibility are subject to a standard credit assessment and a review of the applicant’s business circumstances, which may include factors such as industry, business tenure, estimated revenue, and other relevant information. Not all loan amounts, terms, or rates will be available to every applicant. All loans are subject to lender approval. Fees, terms, and conditions apply.

The time required to process and fund loan applications may vary depending on each individual case. Factors such as the completeness and accuracy of the application materials, verification processes, and external factors may influence the timelines for processing and funding.

Our experienced team is ready to help you navigate your financial journey and achieve your goals.